AI detector shows that this is human-written content: https://gyazo.com/38e6da5d7889924e3a5e87896ae05812

Many business owners and high-income earners think they're handling their taxes properly when they file on time each year. But there's a massive difference between simply filing your taxes and actually planning for them. One approach keeps you compliant, while the other can save you thousands of dollars and position your wealth for long-term growth.

Tax preparation is primarily about data entry and number crunching from January to April. Tax filing represents the compliance side of taxation. It's what most people think about when tax season rolls around.

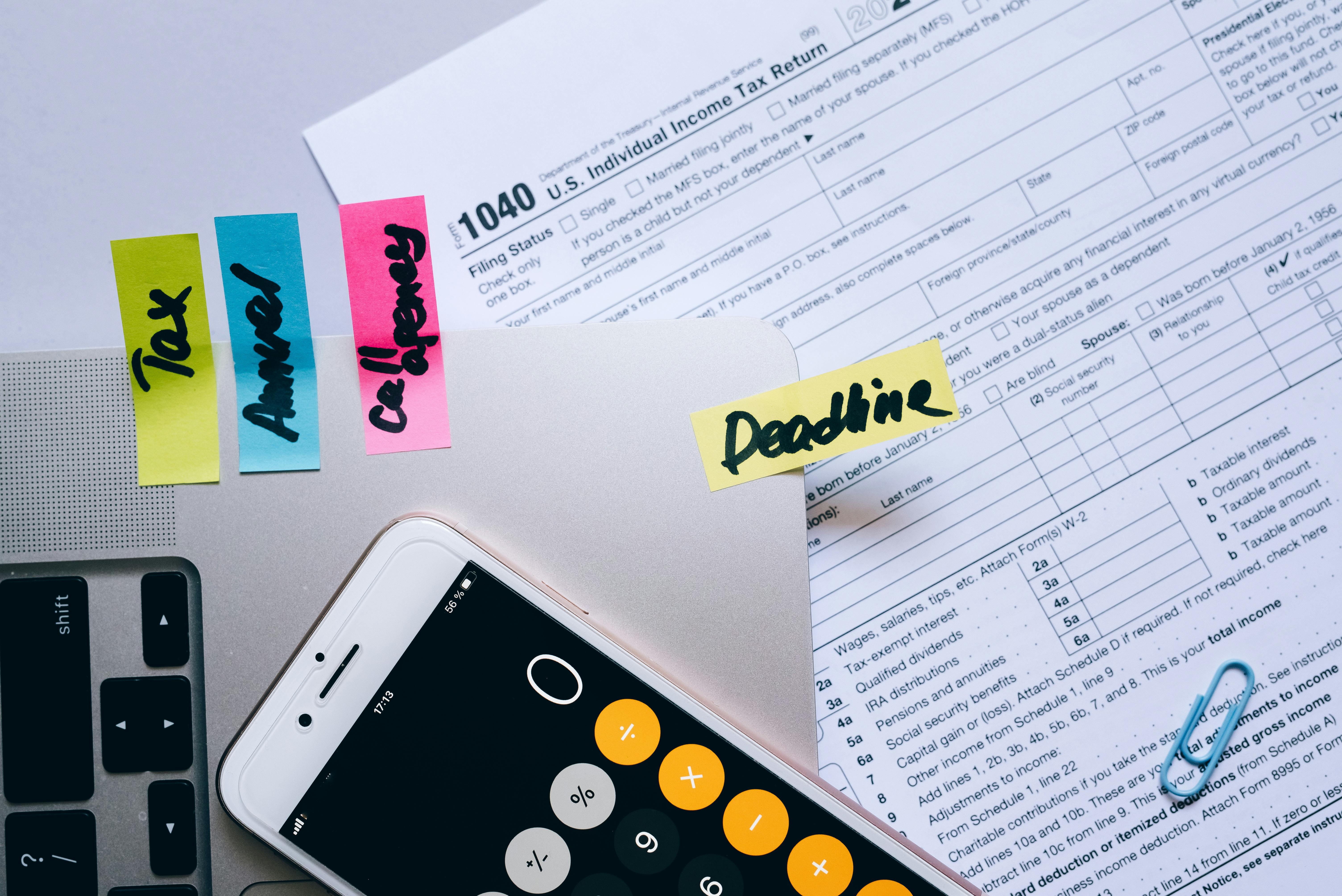

During this period, you gather your W-2s, 1099s, receipts, and other documents to complete the necessary forms that report your income and expenses from the previous year. The filing process focuses entirely on historical data. You're essentially telling the government what happened financially during the past 12 months.

This reactive approach means you're working with fixed numbers and limited opportunities to influence your tax outcome. By the time you sit down to file, most of your tax liability has already been determined by decisions you made throughout the year.

Filing serves an important purpose. It keeps you compliant with federal and state regulations, helps you claim eligible deductions and credits, and determines whether you owe additional taxes or qualify for a refund. However, filing alone leaves significant money on the table because it doesn't involve strategic decision-making to minimize your tax burden.

A good tax strategy isn’t something you cram in at the deadline; it’s an ongoing process. Tax planning means looking ahead, making financial moves with taxes in mind, and shaping outcomes instead of simply reporting what already happened.

This forward-thinking strategy analyzes your current financial situation, projects future income and expenses, and implements specific tactics to legally reduce your overall tax liability. By taking into account the entirety of your financial picture, tax planning looks for strategic changes that will create new opportunities to minimize your tax bill.

The planning process involves understanding your complete financial picture. This includes your income sources, business structure, investment portfolio, retirement accounts, and long-term financial goals. With this information, you can identify opportunities to optimize your tax situation.

Related: 4 Last-Minute Tax Saving Strategies to Use Before December 31

The timing difference between these two approaches creates dramatically different outcomes. Tax filing happens after the fact, typically between January and April for the previous tax year. By contrast, tax planning is a year-round process of developing strategies to reduce your tax burden.

Filing constraints:

Planning advantages:

Planning gives you the power to time the sale of investments, adjust business expense timing, modify your compensation structure, or implement strategies that reduce both current and future tax burdens.

Effective tax planning involves several interconnected components that work together to minimize your tax burden. Each element requires careful consideration of your specific financial needs and circumstances.

Smart timing can shift your tax liability to more favorable periods. You might delay recognizing certain income until a lower-tax year, or accelerate deductions when you're in a higher tax bracket. Generally, the higher a taxpayer's AGI, the higher their tax rate and the more tax they pay. Tax planning can include making changes during the year that lower a taxpayer's AGI.

Investment planning considers the tax implications of your portfolio decisions. This includes tax-loss harvesting, managing the timing of capital gains, choosing tax-efficient investments, and structuring your holdings across different account types to maximize after-tax returns.

For entrepreneurs and business owners, entity selection becomes crucial. The choice between sole proprietorship, partnership, S-corporation, or C-corporation status can dramatically impact your tax liability. Each structure offers different advantages depending on your specific situation.

The financial differences between planning and filing can be substantial. Business owners who only focus on filing typically pay higher effective tax rates because they miss opportunities for strategic deductions, income timing, and tax-efficient business structures.

Consider practical savings opportunities:

These strategies work best when implemented as part of an ongoing financial management approach rather than last-minute scrambling.

Related: Successful Business Owners Paying Too Much In Taxes

Advanced tax planning also incorporates estate planning strategies that reduce both current and future tax burdens. For high-net-worth individuals and families, this becomes particularly important as wealth grows and estate tax implications increase.

Strategies might include charitable giving programs that provide current tax deductions while supporting causes you care about. Trust structures can help manage income taxes while also addressing estate planning objectives. Business succession planning ensures that wealth transfers happen in the most tax-efficient manner possible.

Family office services often coordinate these complex strategies because they require expertise across multiple areas of financial management. The integration of tax planning with investment management, estate planning, and business strategy creates synergies that maximize wealth preservation and growth.

The complexity of modern tax planning makes professional guidance essential for most high-income earners and business owners. Tax laws change frequently, strategies require careful implementation, and the stakes are too high for DIY approaches when significant wealth is involved.

The right advisor doesn't just prepare your taxes. They serve as a strategic partner in your overall wealth management plan. They proactively identify opportunities, monitor tax law changes that affect your situation, and coordinate with your other professional advisors to ensure all aspects of your financial plan work together effectively.

Ready to transform your tax strategy from reactive to proactive? The difference between planning and filing isn't just about compliance versus strategy. It's about taking control of your financial future and keeping more of what you earn.

Tax filing keeps you compliant, but it’s defensive. Tax planning is proactive, helping reduce your burden and maximize after-tax wealth. The most successful earners focus on planning year-round. By working with advisors and using smart strategies, they turn taxes into a tool for long-term growth.